Finance + AI

⭐ Before we start

Let's unpack strategy

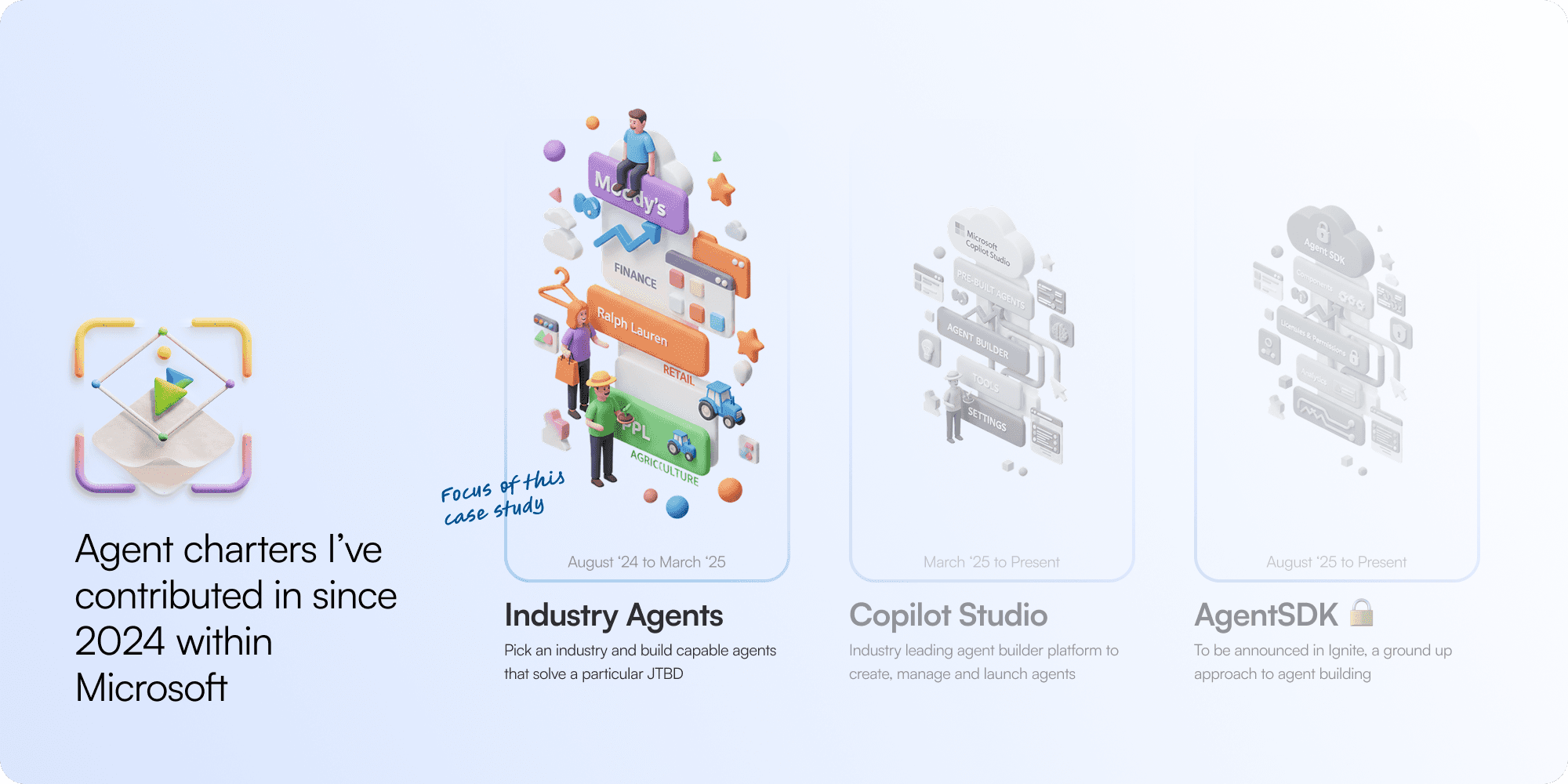

Agentic strategies come in several shapes and sizes. Some take platform approach while others take partner approaches. In my last 15 months at Microsoft, I've had the opportunity to be a part of the following 3 strategies:

Each agent strategy needed to stand on its own while also feeding into a larger, interoperable ecosystem. This case study will speak about Industry Agents in detail.

What's an Industry Agent?

Industry Agents began as a focused push to make AI more practical inside real industries. The goal wasn’t to create another all-purpose assistant but to build agents that actually understood the jobs, constraints, and workflows unique to each domain.

At Microsoft Cloud for Industry, I worked with product and partner teams who already lived and breathed their verticals like finance, retail, healthcare, manufacturing. My part was to turn broad ambition into something that could be built, tested, and shared. We explored how agents could use real data safely, learn from context, and still stay interoperable across Microsoft’s ecosystem.

Over time, the idea matured into a playbook: co-build with conviction, design for real use cases, and make every agent a pattern that others can reuse. “Ask Ralph” in retail and “PPL Insights” in finance are early examples of that approach grounded in genuine work, powered by collective expertise, and aimed at scaling responsibly.

One of the recent examples of cloud for industry implementations - Ask Ralph for Ralph Lauren

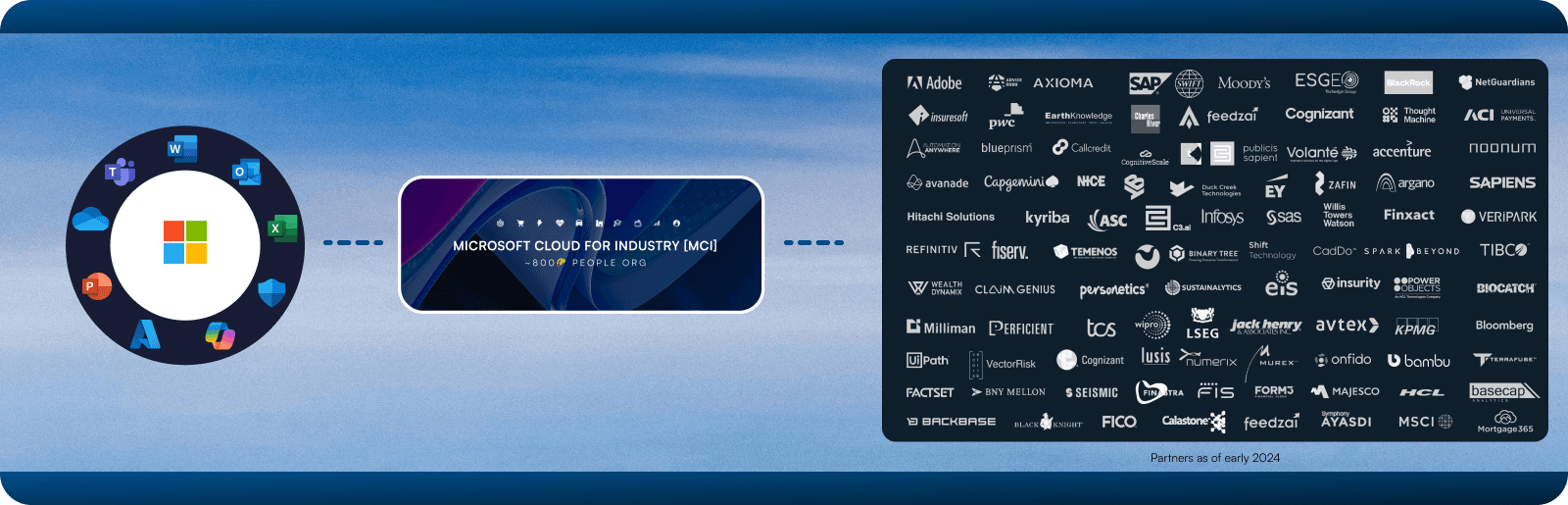

Industry agents are conceived by Microsoft Cloud for Industry

Microsoft Cloud for Industry turns broad cloud capabilities like AI, data, and collaboration into tools built for real sectors like finance, retail, and manufacturing. Design acts as the bridge translating ambition into usable experiences.

You can learn more about the org here.

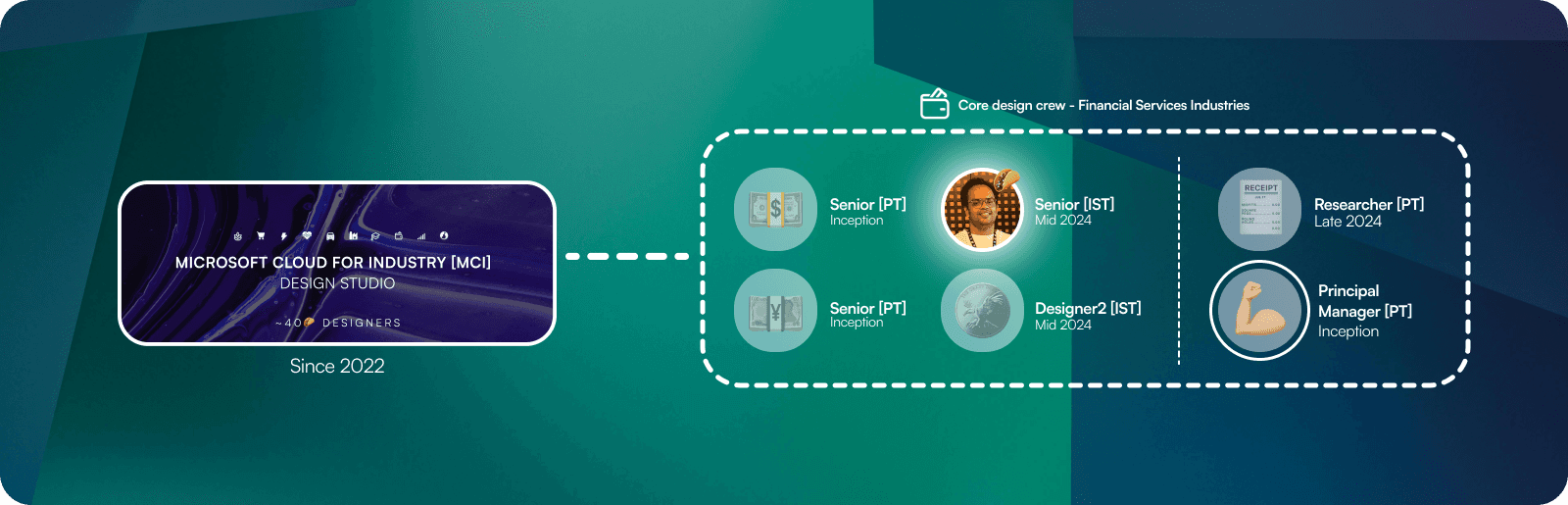

Financial Services Industry [FSI] started in February 2024

The Financial Services Industry (FSI) design crew was formed as part of the Microsoft Cloud for Industry Design Studio, a group of about forty designers working across sectors like retail, manufacturing, and healthcare. Each crew operates independently but shares the same purpose: to make Microsoft’s technology practical and human inside complex industry ecosystems.

When FSI began in early 2024, we were a small distributed from the inception phase and a few of us who joined midway through the year. I was a part of India-based design crew, helping shape the product direction and design system foundations for FinAgents. My work sat between concept and craft, translating strategy into interfaces and stories that partners and engineers could act on.

We built a steady rhythm across time zones, working closely with product and research to move ideas from conversation to prototype. Each sprint helped us understand how AI agents could fit naturally into regulated financial workflows. By mid FY, our focus had sharpened, the team had settled, and the groundwork for FinAgents was firmly in place.

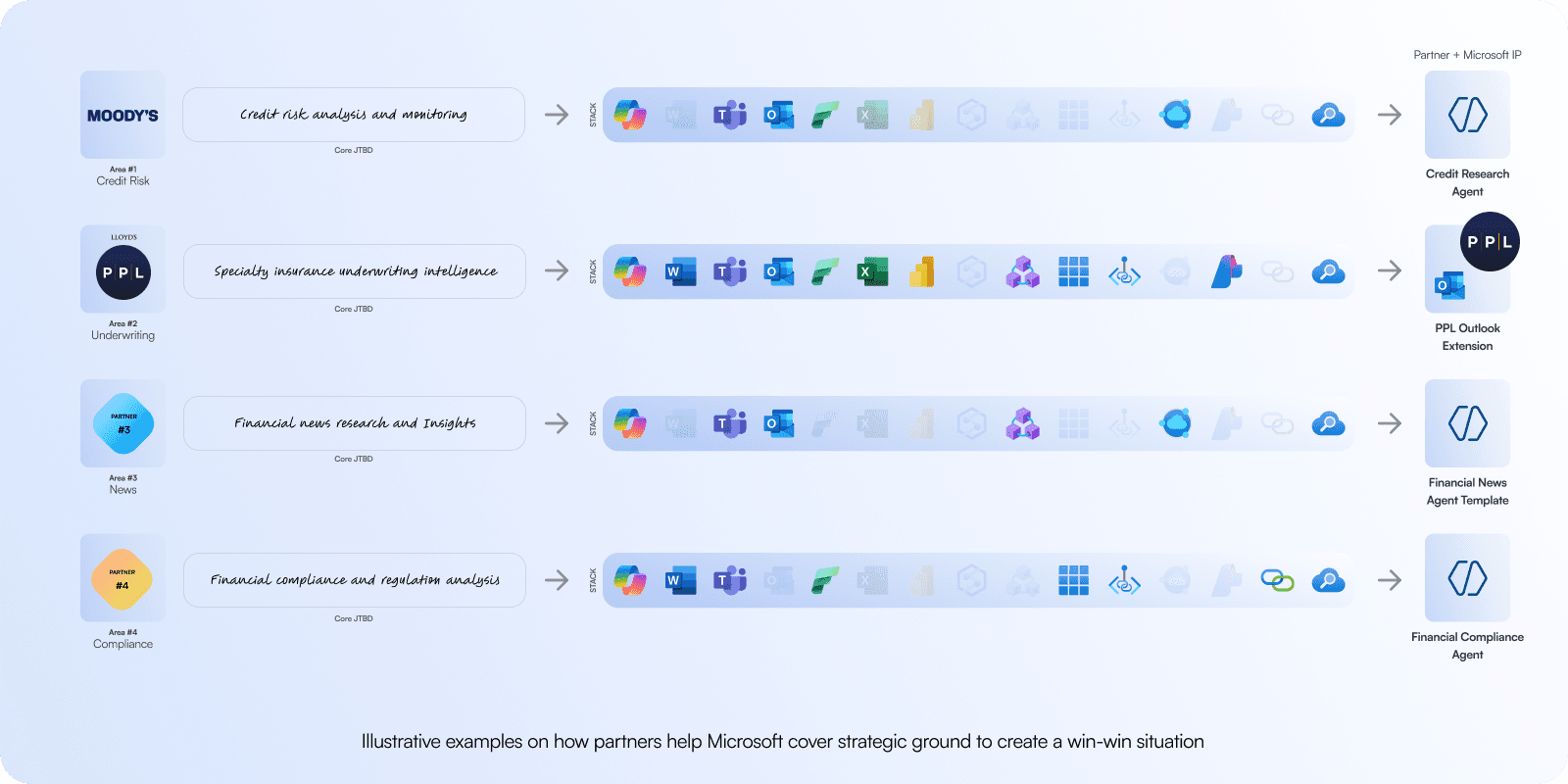

How it works: Partners bring conviction & data for combating complexity

Each FinAgent starts with a clear purpose and a partner who knows the domain inside out. Partners like Moody’s and Lloyd’s PPL bring their data, intelligence, and years of expertise, while Microsoft provides the cloud and collaboration stack that makes scaling possible. Together, they address areas such as credit risk, underwriting, financial news, and compliance. Each partnership creates a shared foundation that turns specialized workflows into working agents.

My contribution focused on how these collaborations translated into usable experiences. I worked on mapping how partner intelligence connects with Microsoft tools like Word, Teams, and Excel, making sure every agent felt natural within the flow of work. Over time, these connections became patterns that other teams could pick up, adapt, and extend into new areas of the financial ecosystem.

Here's a way I crafted to share agents we made

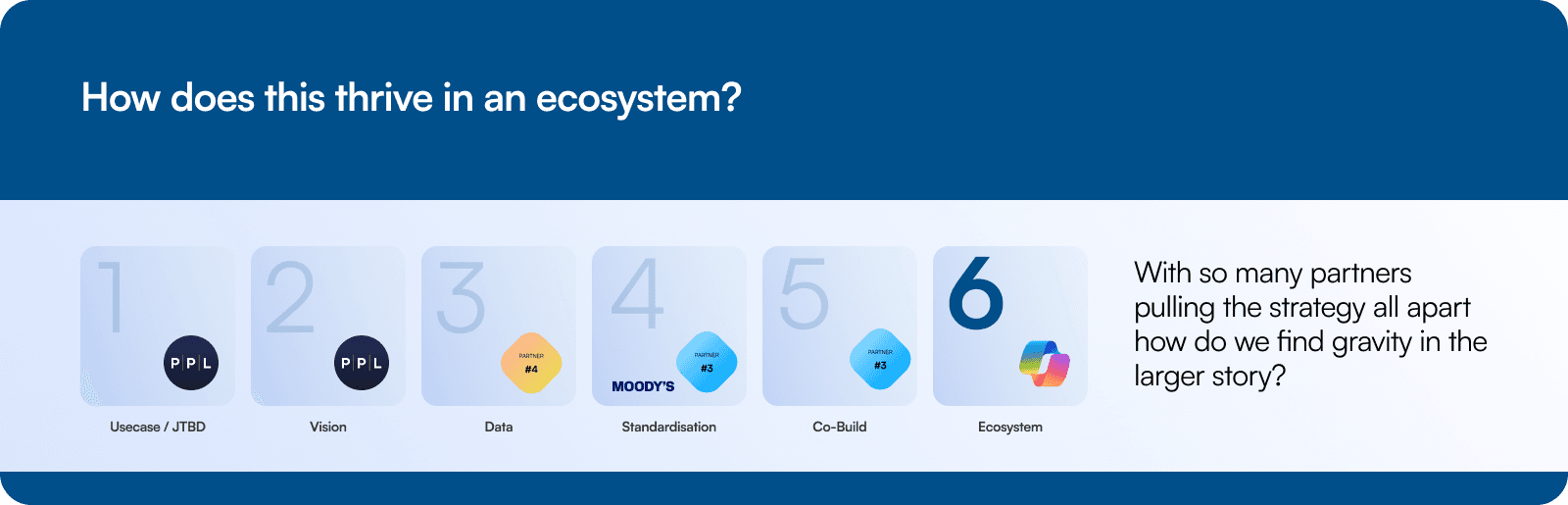

Most of this work sits behind enterprise and partner boundaries, so I had to find a way to tell the story without crossing confidentiality lines. This structure became that balance. I shaped it around six lenses: use case, vision, data, standardisation, co-build, and ecosystem. Each lens mirrors a real part of the FinAgents journey, supported by examples that are public or adapted for context. It allowed me to show how we designed, collaborated, and scaled inside Microsoft’s ecosystem while keeping the integrity of the actual work intact.

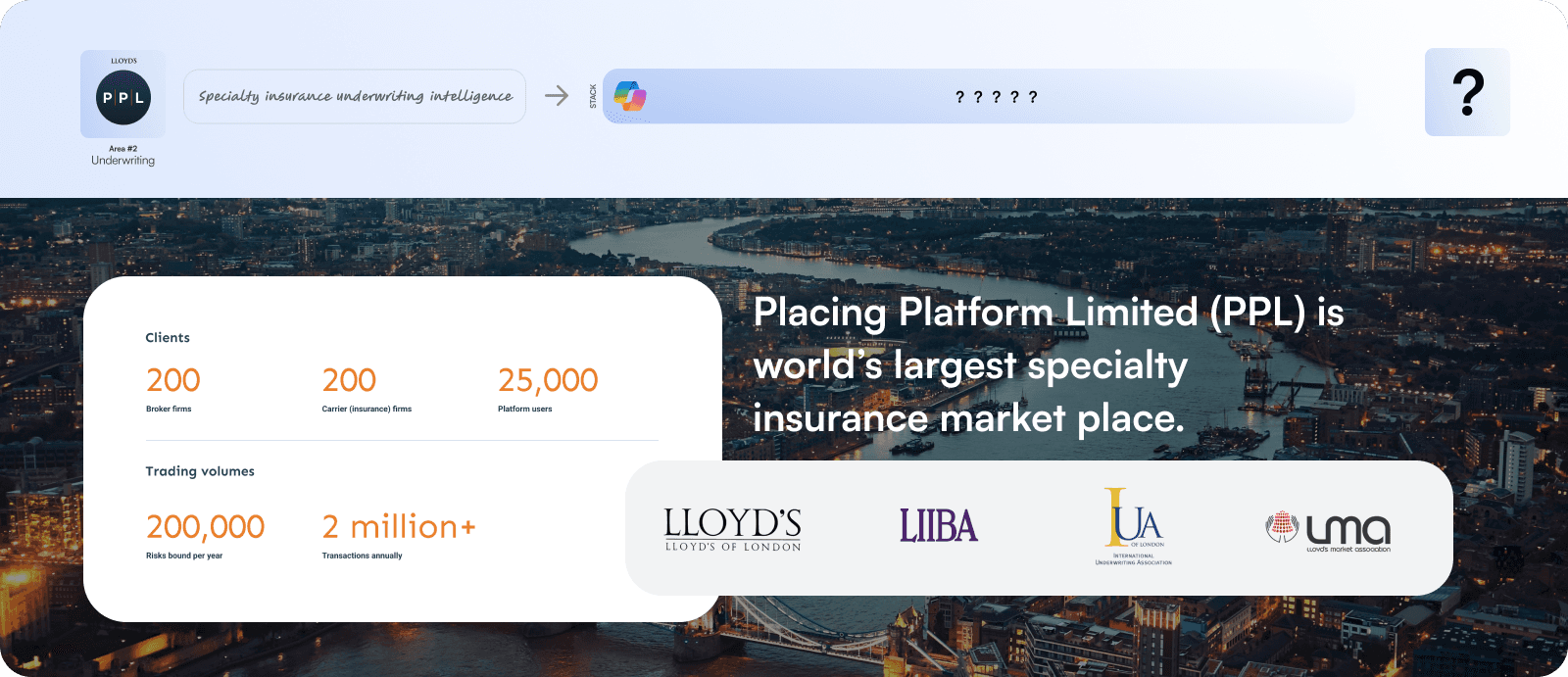

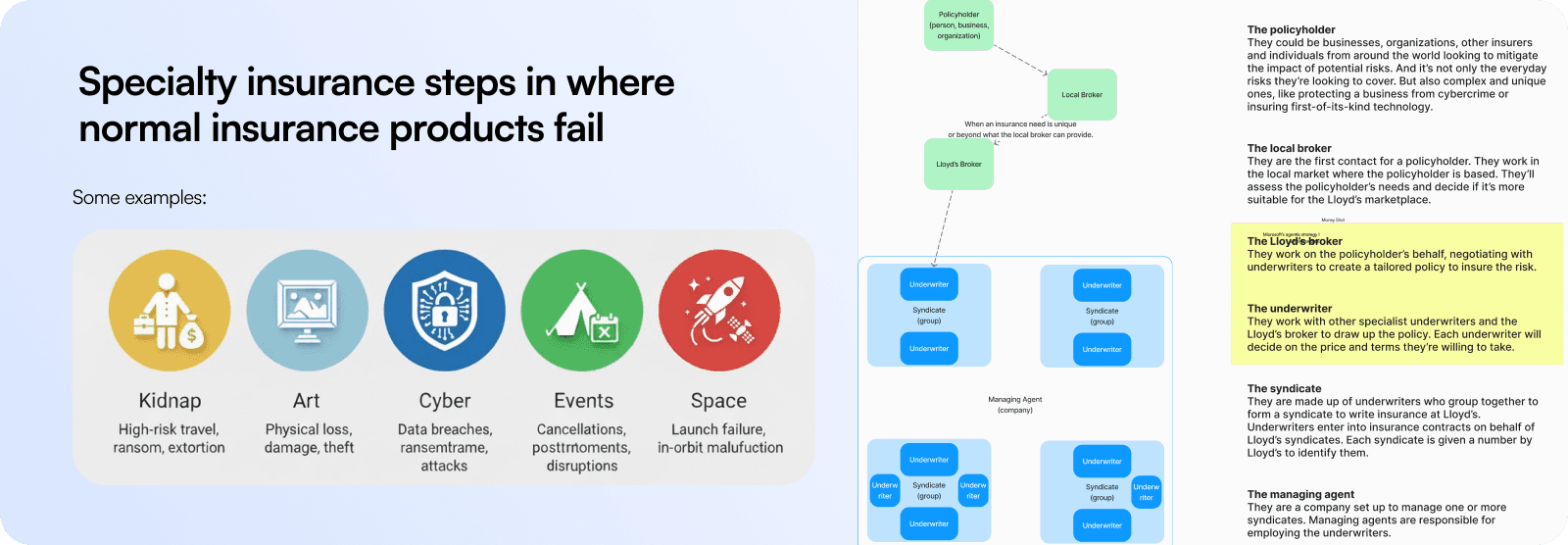

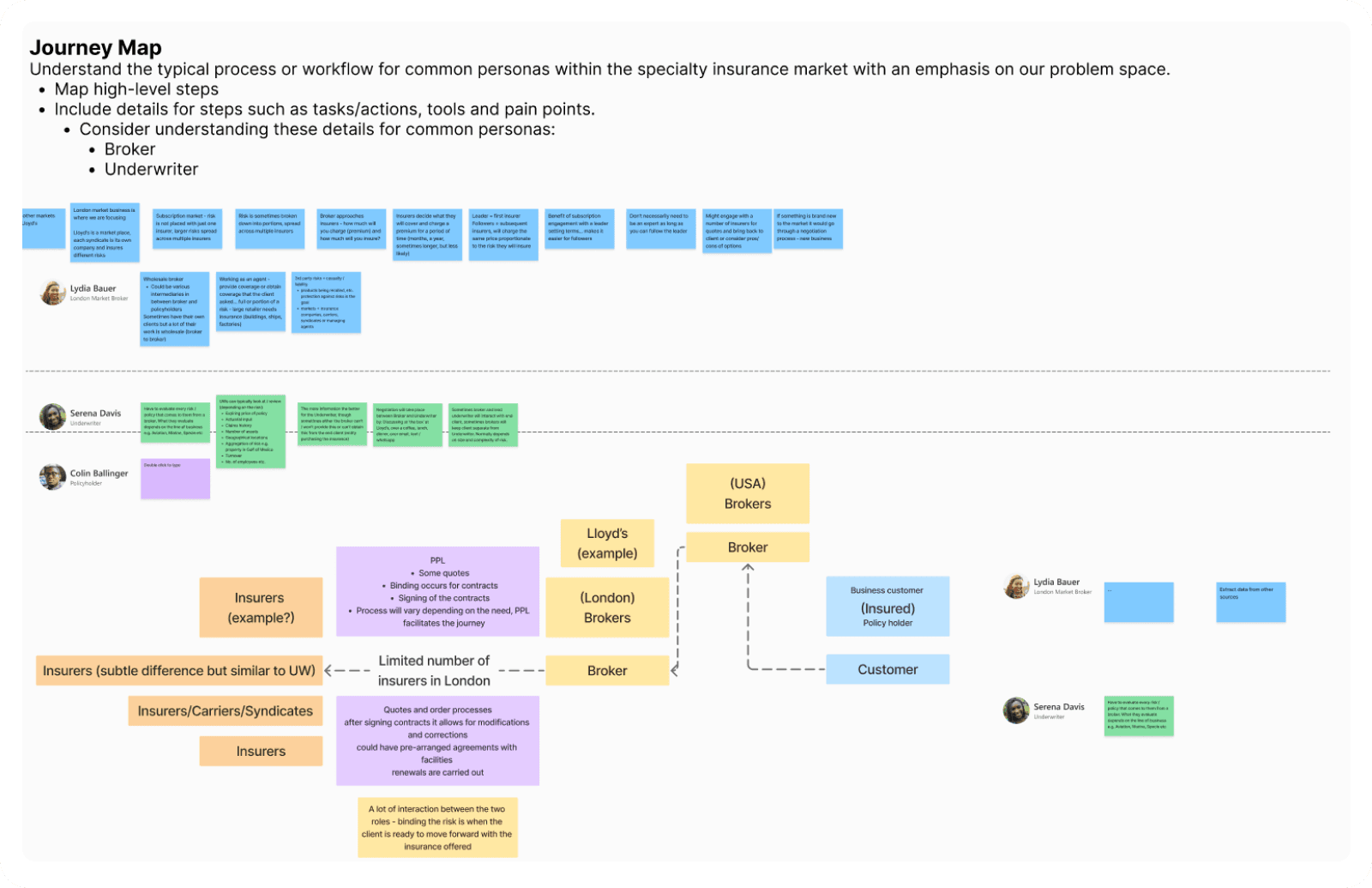

Usecase/JTBD - Specialty Insurance

The first step in building any industry agent is getting both sides to agree on what problem is worth solving. When Microsoft and a partner like PPL come together, each brings a different understanding of value, workflows, and constraints. My role was to translate those perspectives into a shared job to be done. Through workshops and iterative mapping, we aligned on a clear purpose: use AI to simplify how specialty insurance underwriters access insights and make decisions. That alignment became the foundation for everything that followed.

When I turned my focus to Placing Platform Limited (PPL), it was clear that the challenge was less about adding AI and more about making specialty insurance placing feel natural within the flow of work. PPL already served hundreds of brokers and carriers in the London market, yet its processes relied heavily on manual input, repeated documentation, and time-consuming coordination.

My task was to translate that into a design brief: build an agent experience over Microsoft’s stack that reduces administrative drag and reconnects expertise with action.

Specialty insurance operates where standard policies and processes fall short, dealing with complex risks and highly tailored workflows. PPL plays a critical role in this ecosystem through its digital placing platform that connects brokers and carriers across the London market. Our work built on that foundation, exploring how an agentic layer could enhance the platform by surfacing insights, reducing manual effort, and helping underwriters and brokers focus on real risk decisions instead of repetitive tasks.

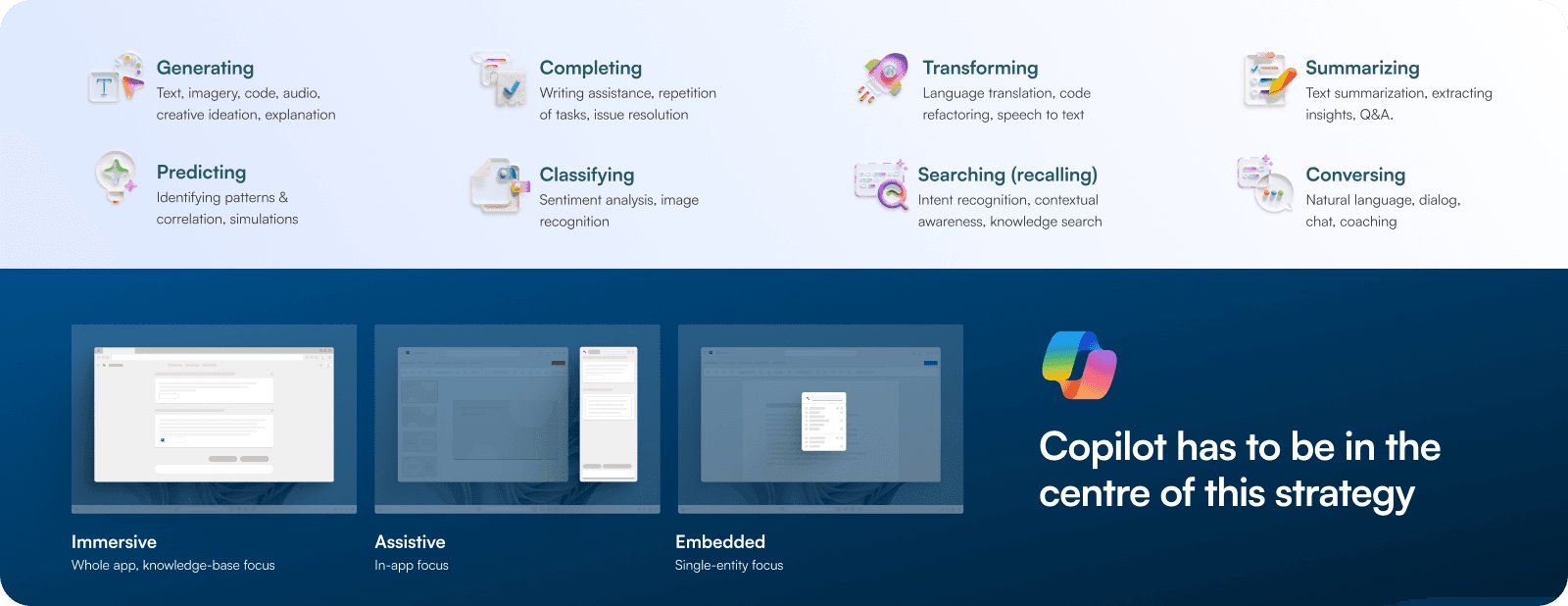

Vision - An AI upgrade to PPL's existing surfaces

The goal was to create a shared north-star vision that brought PPL and Microsoft into the same frame. Both teams worked to imagine what the future of specialty insurance could feel like when intelligence, context, and action lived together in one seamless experience.

Copilot first in all fronts

Copilot became the centerpiece of this strategy. It was not just an assistant but the connective tissue between people, data, and workflows. By blending generating, predicting, classifying, and searching capabilities, the aim was to help underwriters and brokers move from reactive work to confident, informed decisions.

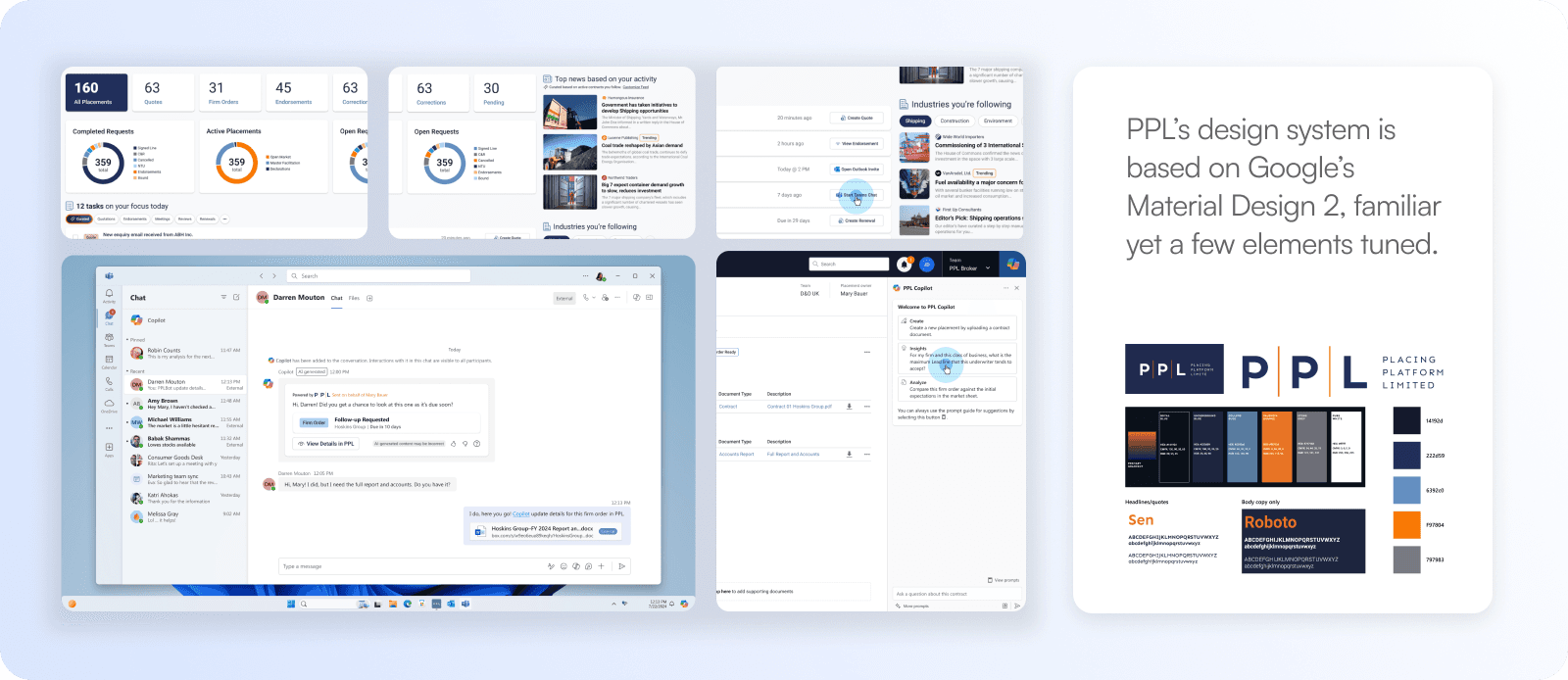

Deciphering PPL’s design story and leaning into their future

PPL’s design system already reflected the rigor and structure of the London market. By studying its patterns, language, and user expectations, I helped imagine how AI experiences could extend naturally into that environment without breaking its familiarity. It was about evolution, not reinvention.

The interface strategy built on PPL’s Material Design 2 system, retaining the familiarity users trusted while introducing modern, responsive elements that could accommodate AI-driven surfaces and in-context interactions.

We translated this shared vision into a detailed storyboard that captured user journeys, interface states, and key decision moments, turning abstract ideas into a tangible narrative everyone could see and discuss.

The final video vision, created with the PPL and Microsoft narrative teams, used sleek transitions and motion cues to show how AI could quietly integrate into the platform’s rhythm, helping people work smarter without disrupting their flow.

Checkout the final vision published in October 2024

Working on the foothills of something as large as the PPL and Microsoft partnership made me appreciate how design can quietly anchor ambition. Seeing our early sketches of agent flows and Copilot moments evolve into a live trading hub felt extremely fulfilling. The shift from static forms to a living, data-driven workspace reminded me that impact often happens in layers, not leaps. For me, this wasn’t about building the next shiny interface but about shaping the connective tissue that lets people in one of the most complex markets work a little smarter, together.

Data - Foundations of agent knowledge

Data sits at the center of every industry agent. In financial compliance use cases, it turns scattered regulations and complex audit trails into structured, actionable insights. Without a solid data backbone, even the smartest agents end up chasing context instead of delivering clarity.

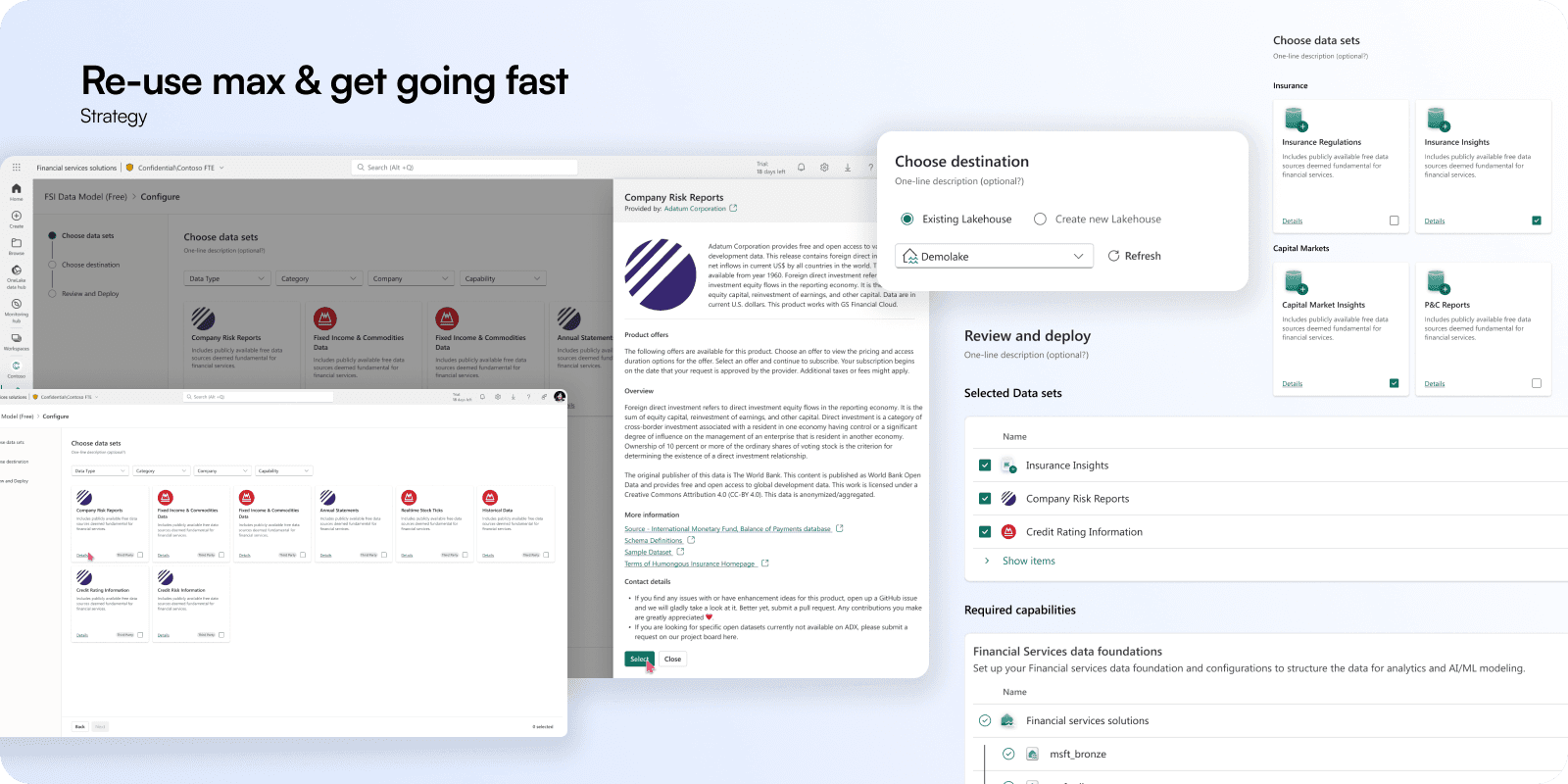

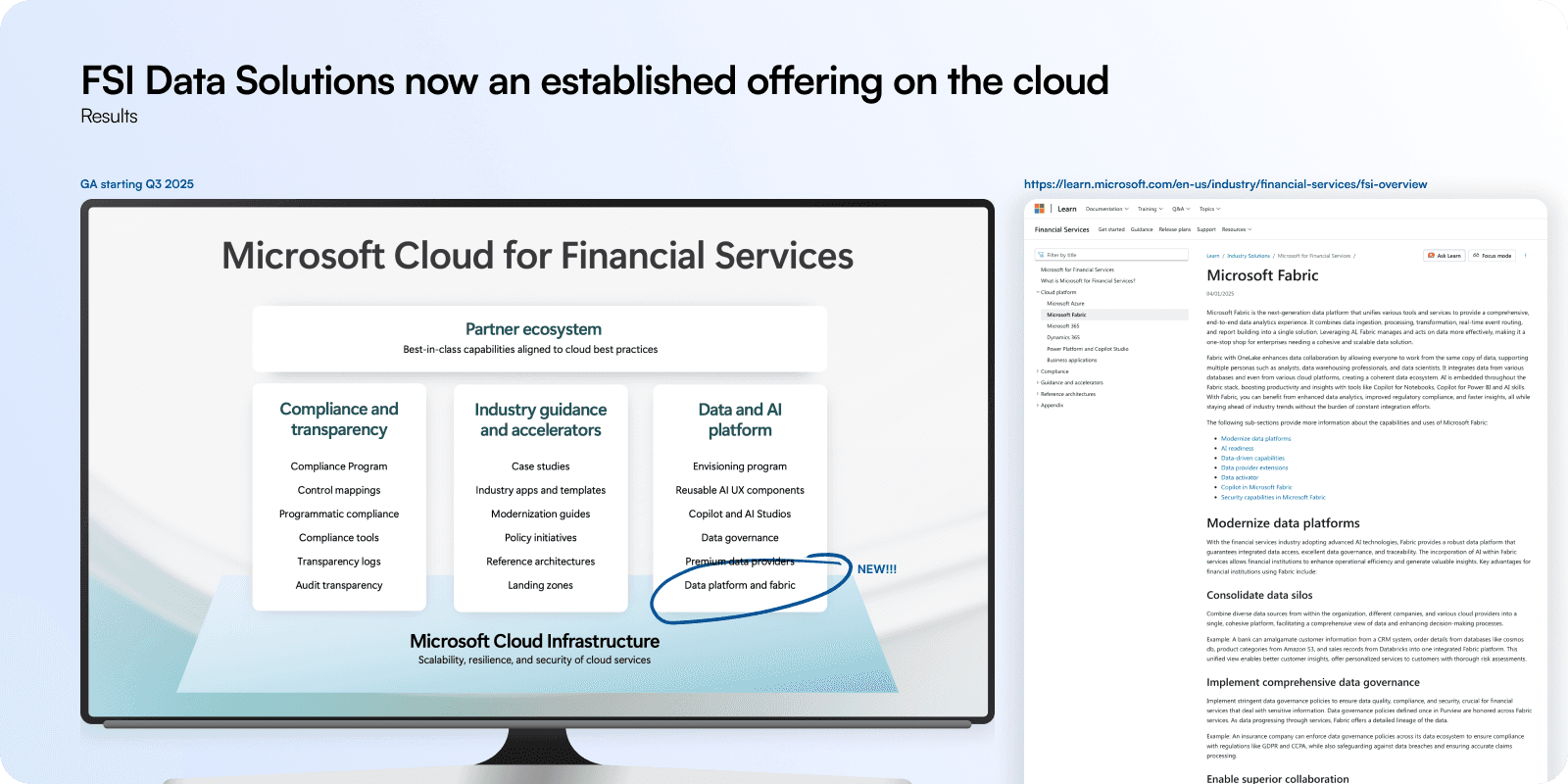

The Financial Compliance Agent became that starting point. It helped define how regulatory logic, risk data, and compliance checks could come together as a reusable data solution built on Microsoft Fabric for financial services.

To accelerate this, we leaned on Microsoft’s existing industry investments. We studied data solutions across agriculture, healthcare, and sustainability, benchmarked competitors, and reused what worked. By aligning patterns, we could design faster and focus on the differentiators that mattered most to financial services.

The prototype reflected that focus. Every screen was designed for speed and familiarity, giving data admins a familiar yet useful Microsoft experience while surfacing compliance data in context for their agentic experiences.

What started as a design experiment is now part of Microsoft Cloud for Financial Services, available through Fabric as a core data offering. It’s a foundational step that proves how data-led design can scale from a single agent to a platform serving the entire financial ecosystem.

Read more about the features and release here

Standardisation - Ensuring a high level consistency

Standardisation prevents us from running into direction conflicts before production begins. It acts as a shared compass between design, engineering, and partners, helping everyone align on what “good” looks like before anything gets built.

Financial Services users often work across multiple apps to get a single job done, and we respect that. But the experience is often fragmented, and users deserve something far more fluid. Our goal was to bring simplicity to a landscape built on complexity.

We built a cohesive story where partner apps, Teams, and Copilot come together to create a unified experience that meets users where they already work. This approach made collaboration feel natural instead of forced.

That also meant partners needed to look and behave consistently across Microsoft surfaces. We built guidelines and guardrails for UX to help them scale their experiences while maintaining identity.

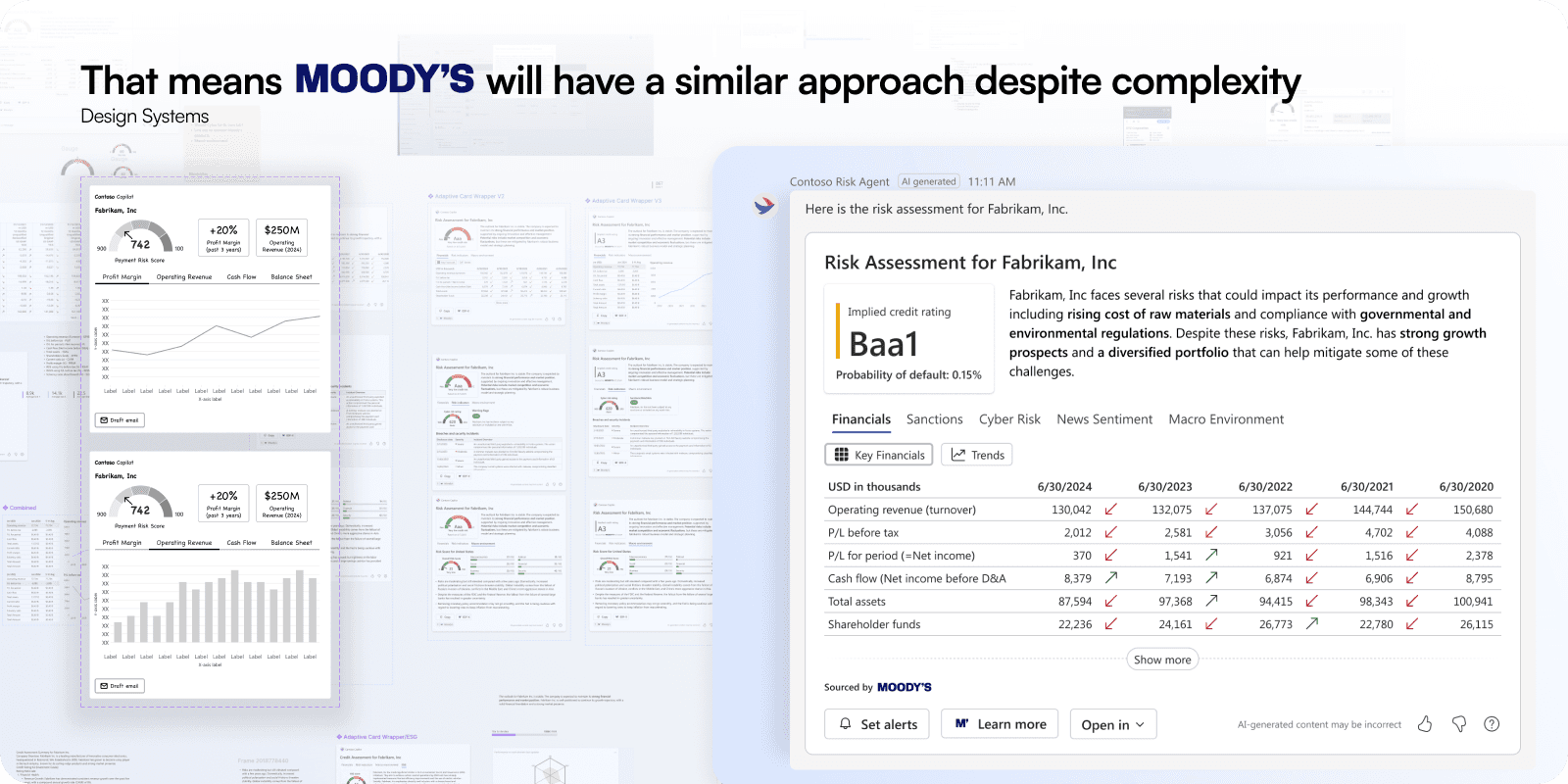

Moody’s followed this principle beautifully, despite the complexity of their use case. Their credit risk assessment tool introduced a smart tab structure that organized deep financial insights into clear, navigable layers, setting a strong reference for others to follow.

We showcased Moody’s prototype at Microsoft Ignite, where the response was both curious and energizing. The feedback confirmed that we were onto something that bridged usability with trust.

Checkout the full session demo here

The session “Empowering the Financial Services Partner Ecosystem with Generative AI” expanded that validation by grounding our design direction within Microsoft’s broader standardisation narrative. It wasn’t just about building another Copilot it was about showing how consistent agent experiences could unify a fragmented ecosystem of financial tools.

Across the session, Microsoft and Moody’s demonstrated how generative AI can work within shared UX, security, and compliance standards to streamline how financial institutions engage with data. The discussion illustrated how design systems, adaptive cards, and copilots can maintain a familiar rhythm across different products while still allowing partners the freedom to innovate. This alignment between creativity and structure became the foundation for scale, letting partners plug in confidently knowing their experiences would feel native to Microsoft surfaces. In essence, the session cemented the idea that standardisation, when done right, doesn’t limit expression,it multiplies it by giving every player in the ecosystem a common language to build on.

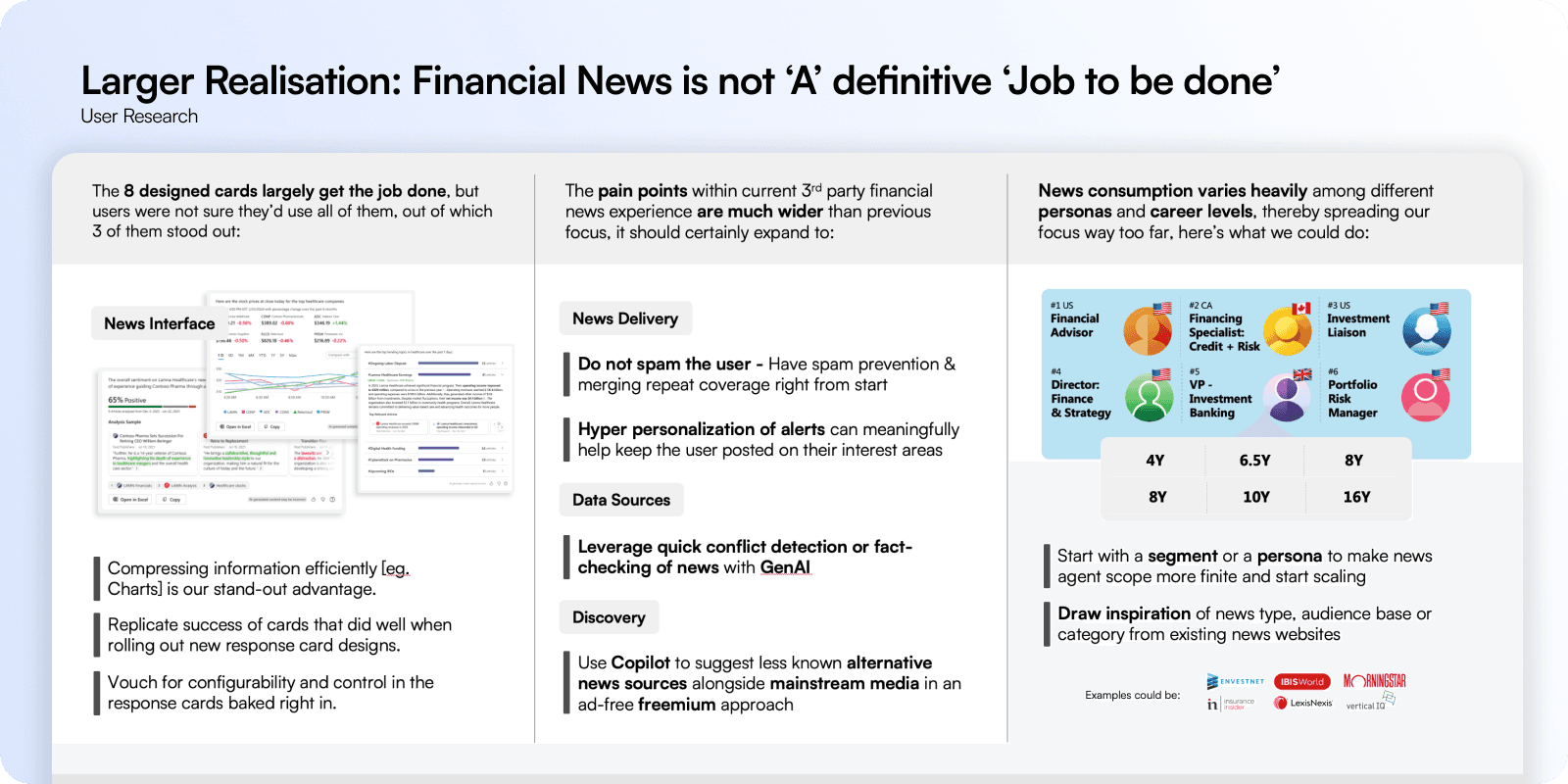

While Moody's posed challenge on how a report is structured in Teams chat had a lot of friction in building alignment, Financial news copilot an agent driven by another partner had other challenges from an execution standpoint.

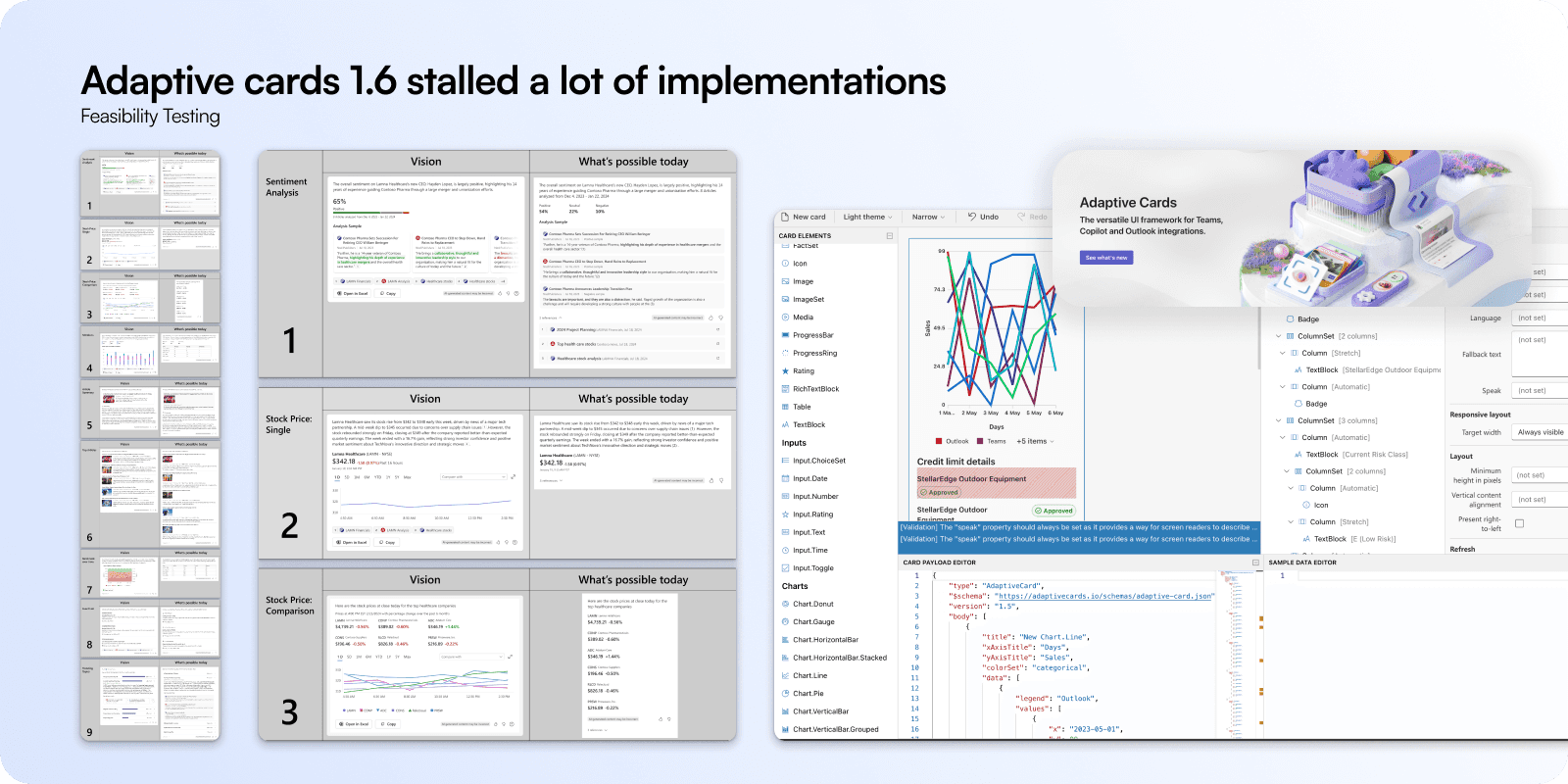

Standardisation also meant stretching into engineering feasibility. We had to validate what the adaptive cards framework could actually handle. Adaptive Cards 1.6 limited a lot of implementations, especially for interactive charts, so we ran experiments ourselves to uncover workarounds. Developers were clear: the framework needed to evolve.

We took that insight back to the Adaptive Cards team, using our research and user feedback to influence their roadmap. The result was a shift in priorities toward smarter visual elements, including charts, that better supported data-heavy financial workflows.

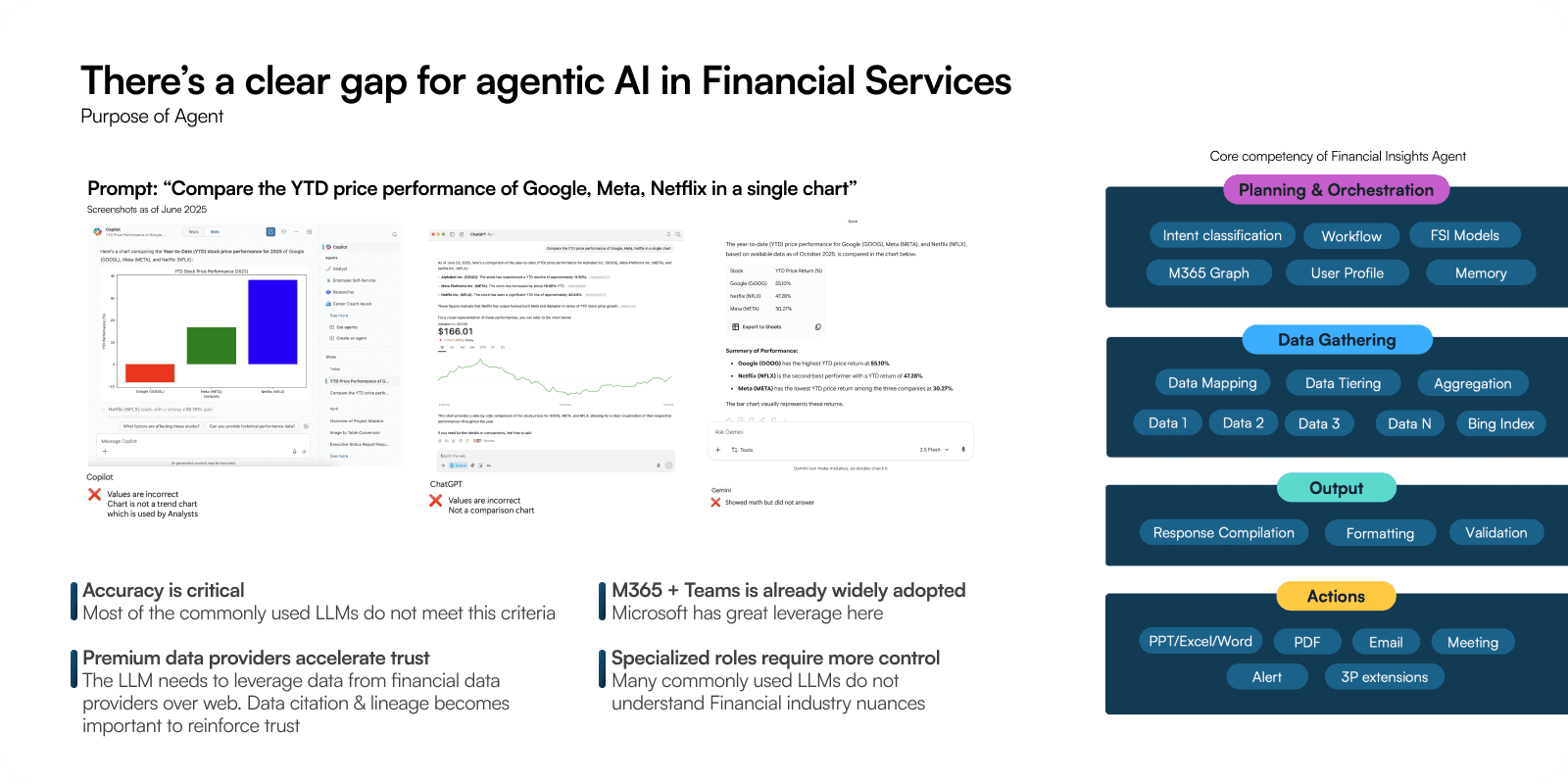

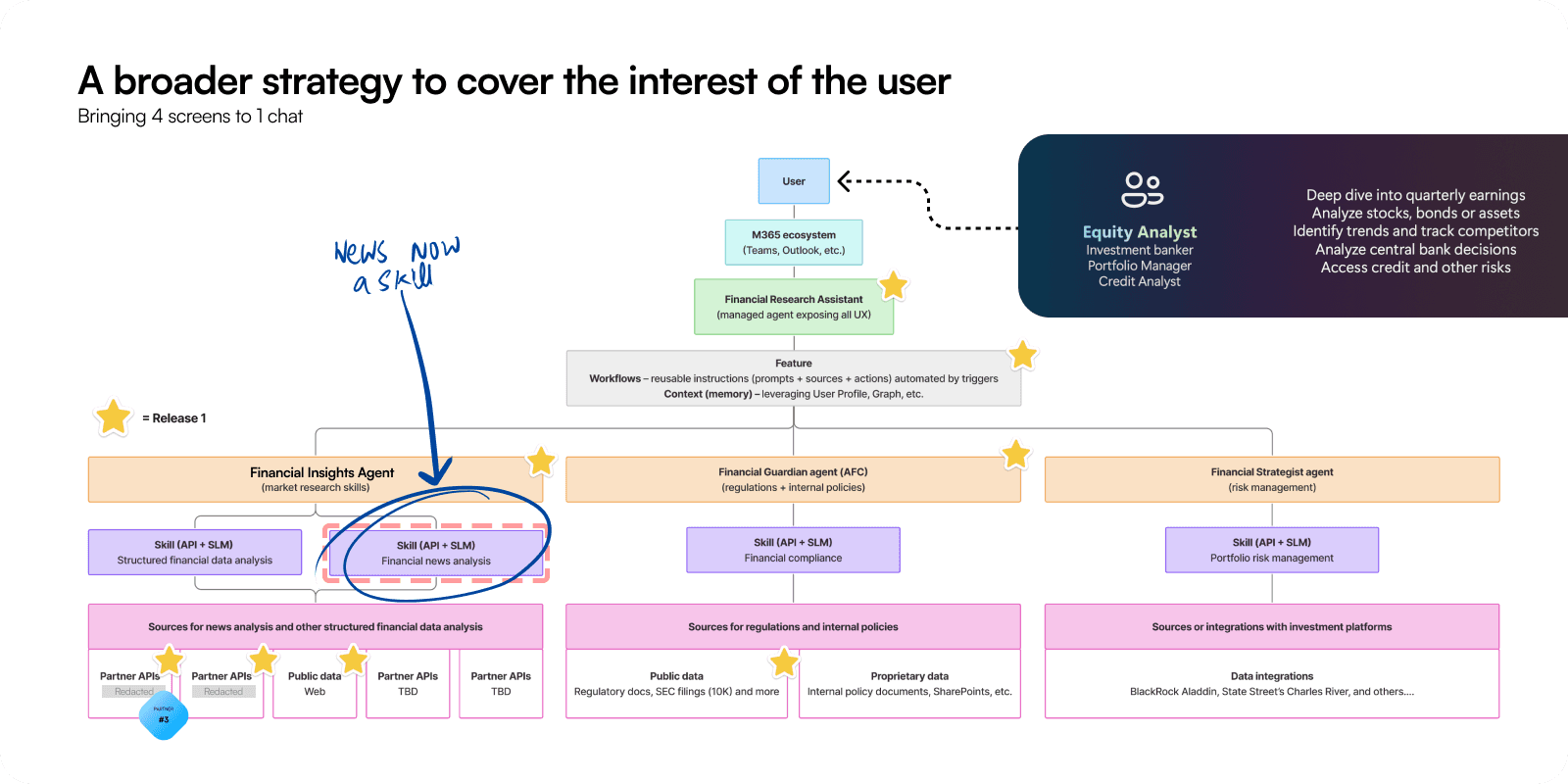

Through all of this, one big realisation emerged. Financial news alone was never the job to be done. For FSI users, news is only a medium to achieve something else research, awareness, or tracking. They need actionable insight, not just information. That shifted our thinking entirely.

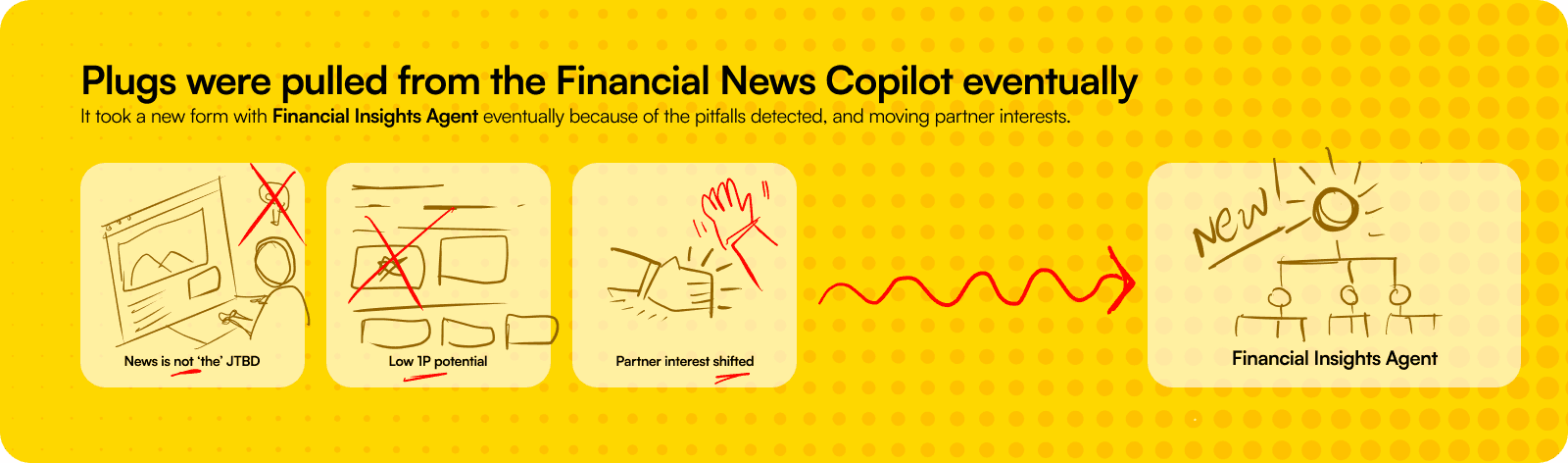

We eventually pulled the plug on the Financial News Copilot and evolved it into the Financial Insights Agent something built for decision-making, not just reading.

But on the brighter side, adaptive cards had released charts by the end of Oct 2024 because of Industry team's consistent push.

Co-Build - Partner and Microsoft

Every co-build starts with ambiguity. Scope, competitors, compliance lines, and technical feasibility are all moving pieces. In finance, this gets even trickier because accuracy and trust can’t be compromised. We leaned into that uncertainty defining what “agentic” could mean in a world that’s still learning to trust AI with numbers.

Today’s LLMs struggle with financial nuance from chart interpretation to the logic behind an analyst’s workflow. Accuracy, explainability, and premium data access are non-negotiable. This was the opening we explored: how an agent could handle the rigor of financial research while staying compliant and transparent.

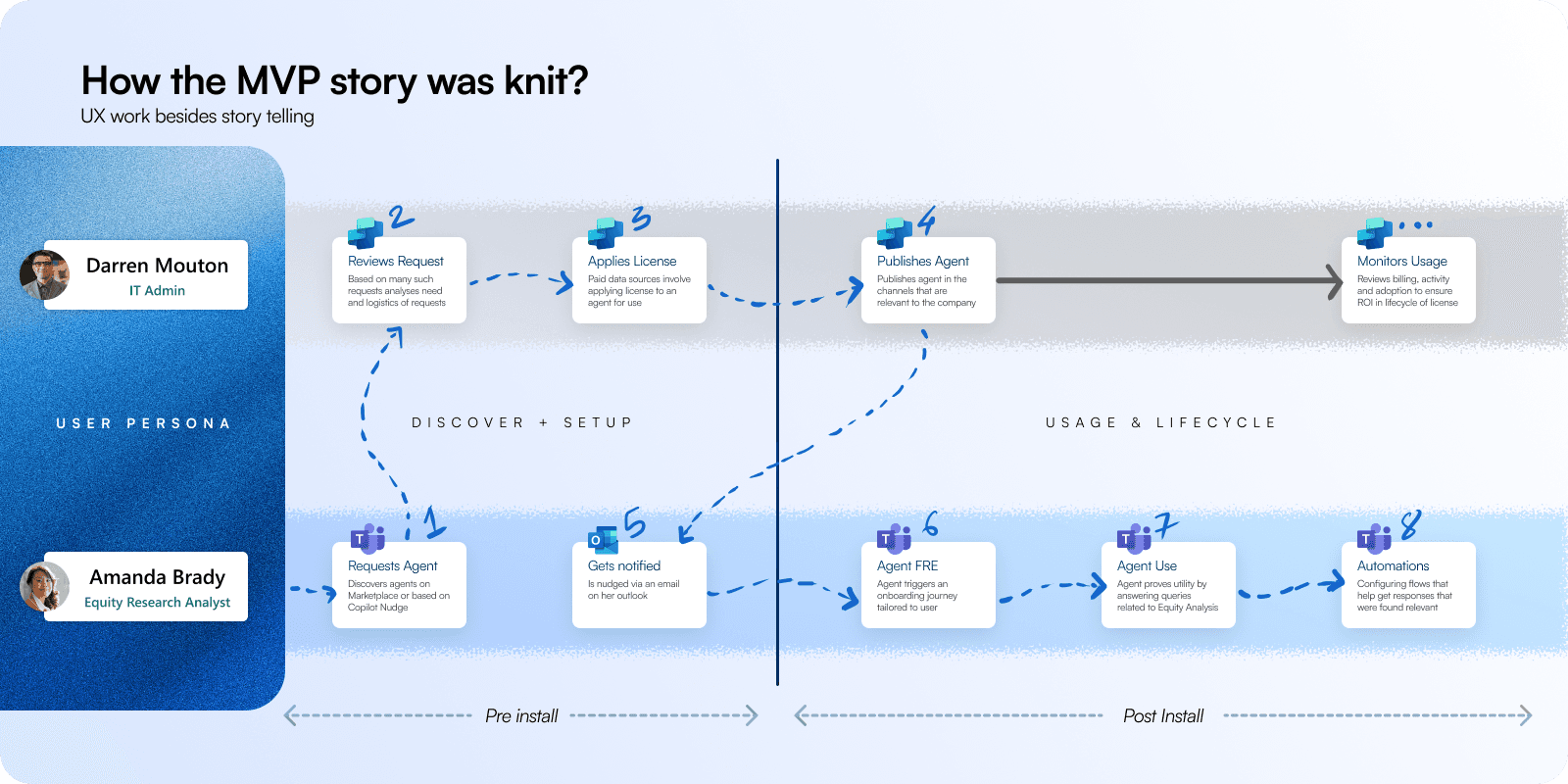

We started with a first run journey of an equity analyst finding a useful Financial Insights agent and an IT admin who handles agent requests. One needed precise insights and automation; the other needed secure control. Our MVP journey mapped everything from discovery to reporting linking setup, licensing, monitoring, and day-to-day agent use into a seamless story.

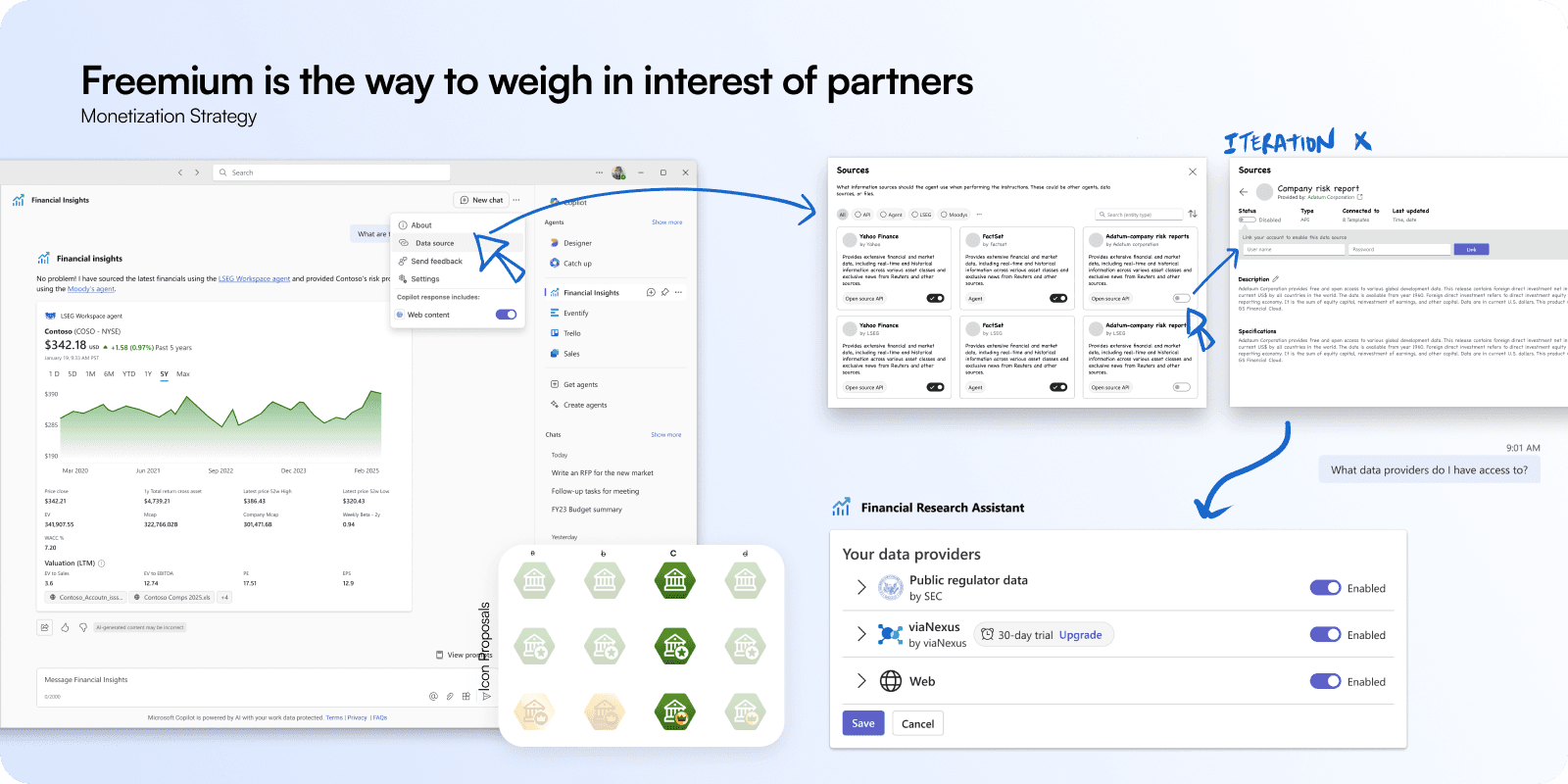

The idea was to make premium data approachable. A freemium tier let teams explore public data sources, while partnerships with providers like Moody’s and LSEG unlocked enterprise-grade insights. This balance created a scalable path for experimentation without losing enterprise control. We did some logo experimentations to cover the message in a way that communicates the same to users.

And going back to the original thought, the financial analyst’s day involves switching between charts, filings, and emails. Our goal was to collapse that context. We wanted everything in a single chat where the agent assists proactively across data, reporting, and compliance workflows. Less toggling, more thinking.

The admin’s role was central. Using Microsoft Copilot Studio, they enabled the Financial Insights agent within Copilot Studio, applied licenses, and configured governance rules. This ensured every insight produced by the agent respected both company and regulatory policies.

For analysts, the setup felt natural. They connected their preferred data providers, generated quick comparative reports, and built automations to stay ahead of portfolio shifts. The agent learned their research rhythm, surfacing what mattered before they asked.

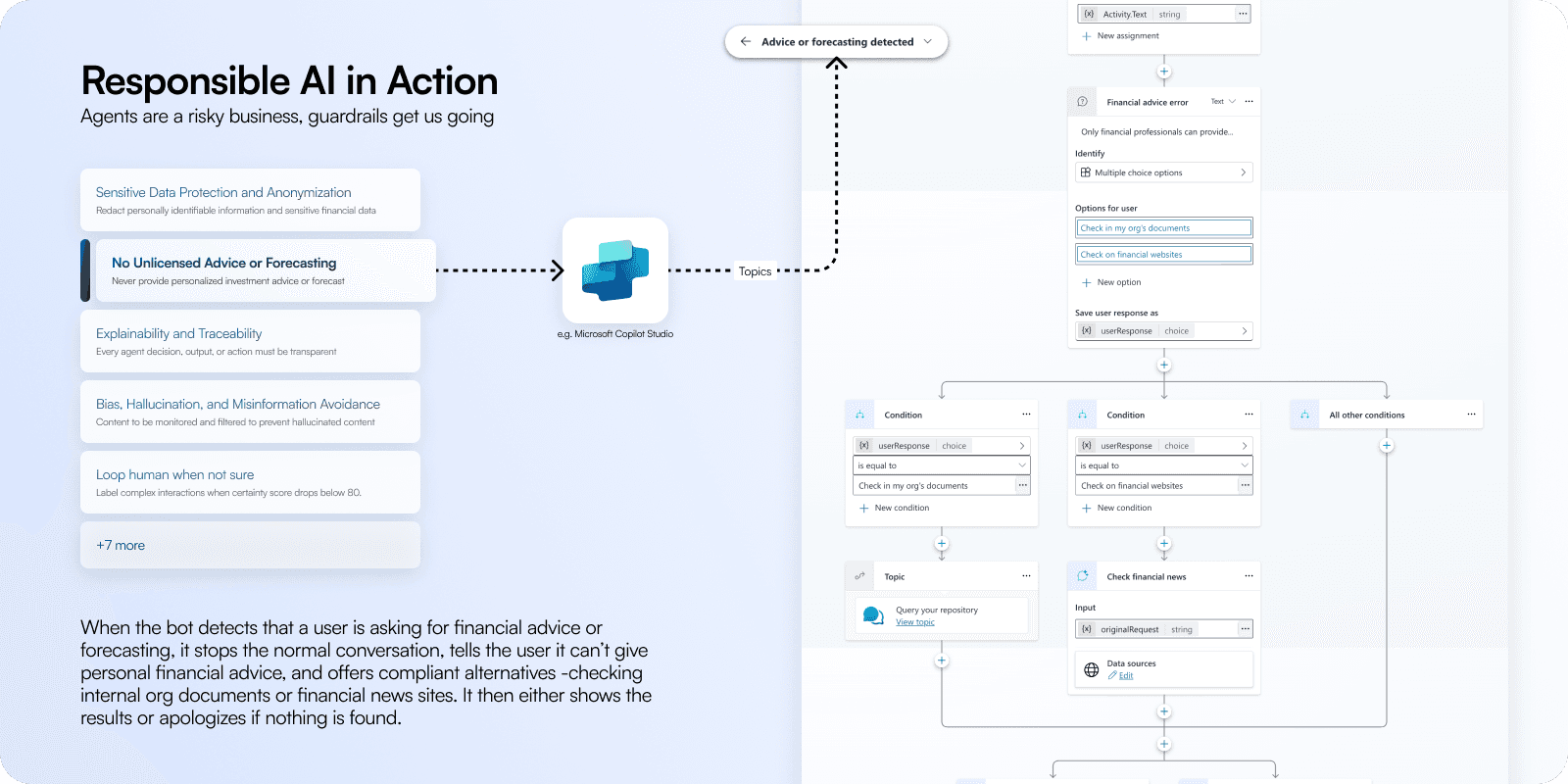

When designing for finance, every feature has to balance intelligence with accountability. We built the Financial Insights agent with a layered Responsible AI framework that ensures compliance is part of the experience, not an afterthought. The agent knows when to step back if a user’s query edges into financial advice or forecasting, it pauses, flags the intent, and redirects the user toward trusted options like internal policy documents or verified financial news sources.

Built through Microsoft Copilot Studio, this flow automates the right kind of caution. Sensitive data is anonymized, every action is traceable, and hallucinated or biased content is filtered out. If confidence in an answer drops, the agent loops in a human reviewer instead of guessing. These guardrails let us design responsibly for high-stakes decisions, giving analysts the freedom to explore insights while keeping the system auditable and aligned with strict financial regulations.

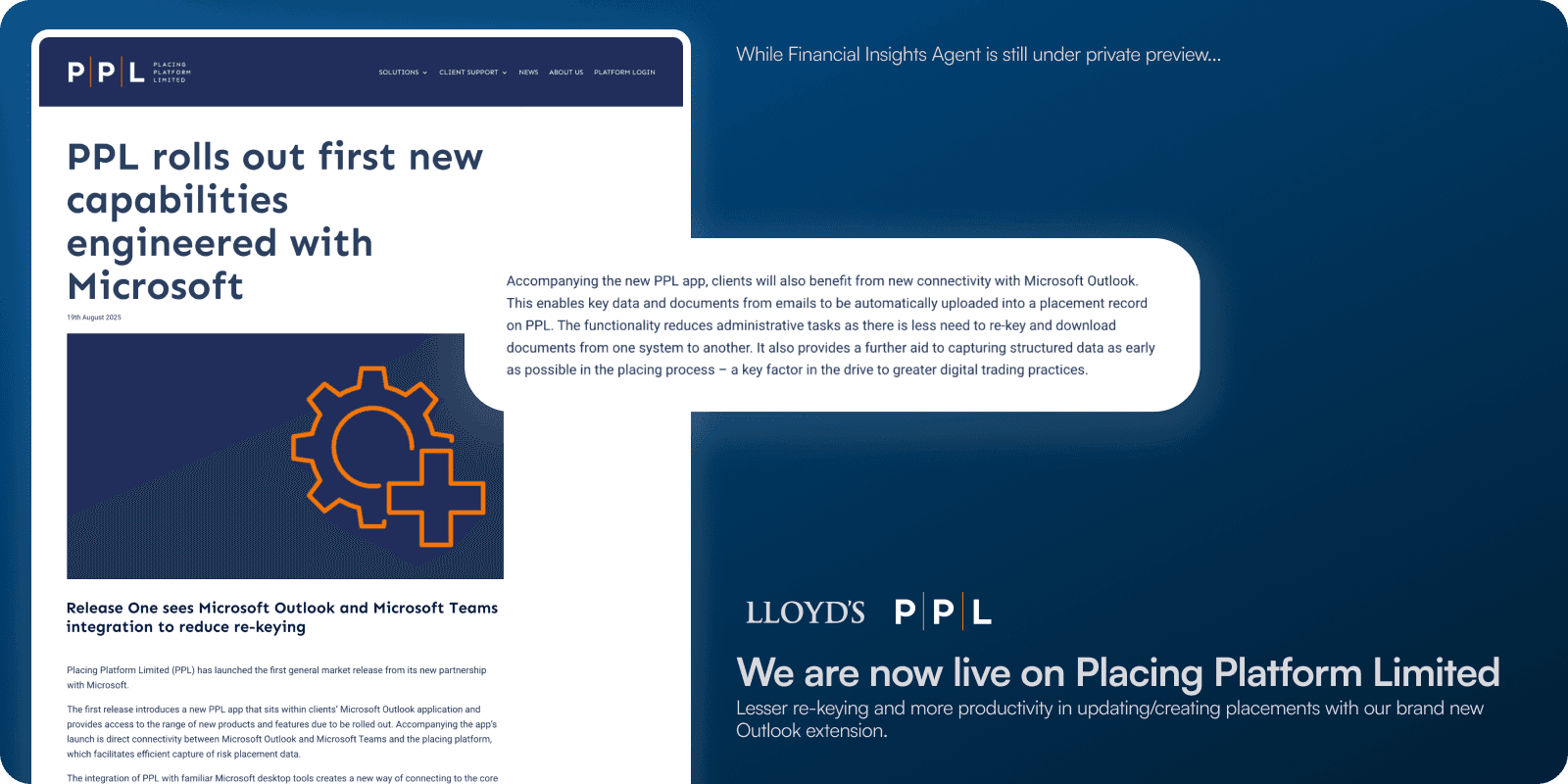

While the Financial Insights agent is still unreleased, hence it prevents me from sharing our outcomes. However, our second co-build, PPL, is now live, a proof that the model works, and that industry-grade agents are finally finding their place.

Learn more about PPL co-build here.

Ecosystem play in the foresight

When you’re co-building with so many partners, the first question is always the same, how do we find gravity in all that motion? The ecosystem play became our answer. It helped us hold the center while making space for new partners to join the story. Instead of every partner pulling in different directions, we built a way to align around shared customer value.

The idea was simple but powerful: prepare the ecosystem, not just the product. That meant creating an environment where existing and future partners could plug in easily, contribute meaningfully, and see their impact across the larger financial agent story.

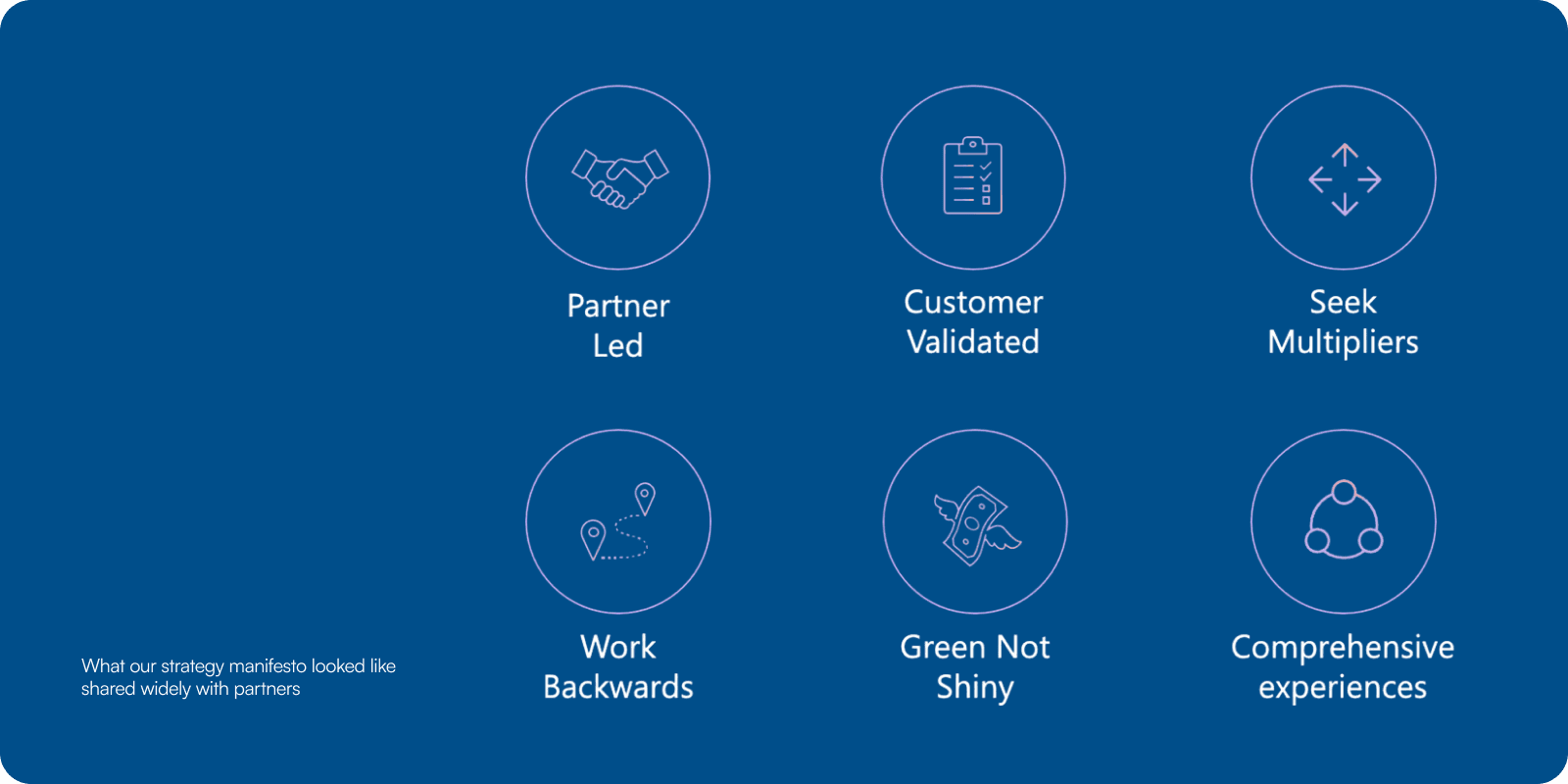

To make that work, we wrote down what we called our “strategy manifesto.” It became the playbook everyone could refer back to when things got messy. Partner led, customer validated, seek multipliers, work backwards, green not shiny, and build comprehensive experiences. These six phrases captured the mindset we wanted every team and partner to share.

Having this manifesto helped us avoid silos and keep decisions grounded. It made sure each build sprint or design review stayed true to a single purpose, to solve for the customer, not the shiny demo.

As the story unfolded, the partner list kept growing, but not randomly. Each one added a unique dimension without overlapping too much with others. Some focused on data integrity, some on compliance, others on risk or user experience. Together, they brought an incredible range of expertise that extended Microsoft Copilot into spaces where it hadn’t gone before.

For users, that meant fewer handoffs and more flow. Imagine an equity analyst jumping from Excel to Teams to Power BI without losing context, everything stitched together by the ecosystem, with Copilot quietly doing the heavy lifting.

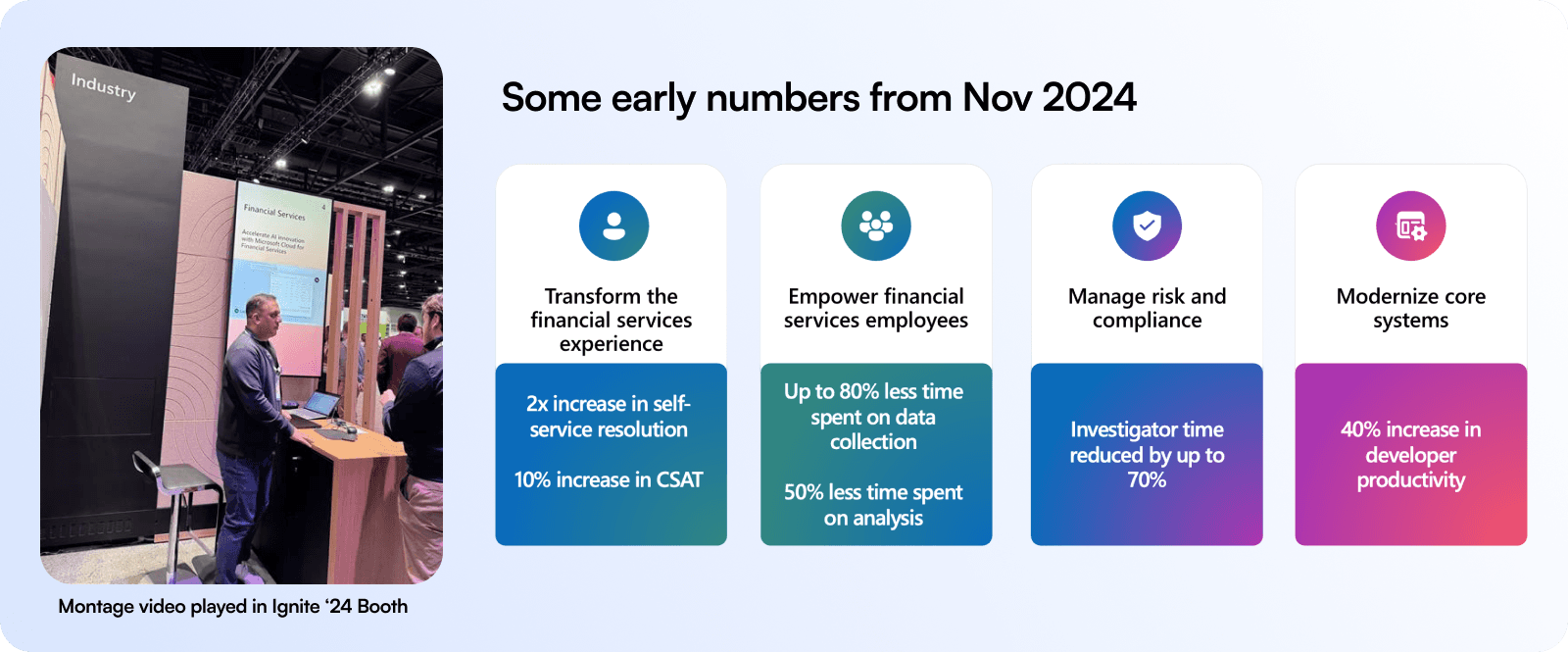

By late 2024, we started seeing the results. These numbers weren’t just metrics. They showed how coordination, not just innovation, drives real transformation. When each part of the ecosystem contributes to a shared story, the output becomes exponential rather than additive.

This entire journey, from defining the use case, building a vision, standardizing data, co-building with partners, to scaling the ecosystem, was about proving that agentic AI in finance could be more than just a set of tools. It could be a living network that grows smarter with every new connection.

What started as a small co-build experiment turned into a movement toward a more connected, efficient, and responsible financial ecosystem. The wins so far are early signals, but they already show what’s possible when design, partnerships, and purpose stay in sync. And that’s really the heart of this story, not the AI itself, but the people and partnerships that made it real.

Thank you for reading this far ❤️